Simple Business Solutions delivers exceptional outcomes by applying psychological principles, market research, and creativity. What can we help you achieve?

Put the Brakes on Telecom Fees

By: Tim Rayl, Chief Marketing Officer (CMO)

The clever tactics some telecom companies use to disguise fees never cease to amaze us. It’s not that telecom carriers are doing something illegal (they are entitled to charge certain fees through tariffs filed with and approved by the Public Utilities Commission (PUC) and Federal Communications Commission (FCC)); it is the manner in which these fees are presented to customers that is bothersome.

Many thanks to Steve Fetzer, President of CCT Telecomm, Inc., whose collaboration was invaluable in identifying what is and is not a government tax, surcharge or fee on a business telecom bill.

When telecom services are presented to a business, they are often presented as “$X plus taxes, surcharges and fees." Typically, the actual costs associated with “taxes, surcharges and fees” are not presented. Unless the business owner asks for an itemization of all charges that will appear on the telecom bill -- or reads the fine print of the service contract -- he or she won’t know about these taxes, surcharges and fees until the first telecom bill is received. Why? Because these fees typically appear in the ‘Other Charges’ section or the ‘Government Taxes and Surcharges’ section of the telecom bill, and are part of that “taxes, surcharges and fees.”

We spent time with Steve analyzing invoices from several telecom companies that provide service to businesses. Here are a couple examples. Unfortunately, these represent the rule rather than the exception.

Telecom Carrier #1

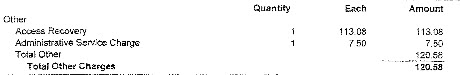

In the ‘Other Charges’ section of the bill, we discovered $120.58 worth of carrier fees. Here's a screenshot of what was on the bill:

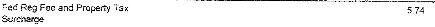

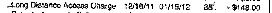

In the ‘Government Taxes and Surcharges’ section of the bill, we found another $36.06 in carrier fees. Here is another screenshot from the bill:

On this invoice, we found a total of $156.64/month ($1,879.68/year) in extra carrier fees. This is 10.3% more than what the client believed he was paying.

Telecom Carrier #2

We discovered $239.06/month ($2,868.72/year) in carrier fees. This represents a 9.6% higher bill than the business expected to receive. The images below are screenshots of the actual bill.

Why Do Some Telecom Carriers Disguise Carrier Fees?

Telecom is a brutally competitive business. Often times, telecom providers will price their services in this fashion to appear to be the least expensive option during a competitive bidding process. This enables them to be perceived as the low price leader relative to telecom providers like CCT Telecomm, Inc. that employ a transparent pricing model where all carrier fees are clearly disclosed and only the taxes, surcharges and fees required by local, state and federal governments are charged to the customer.

What is a Carrier Fee vs. a Government Tax/Surcharge/Fee?

To save business owners time, money and frustration we developed this helpful quick reference guide of telecom taxes, surcharges and fees in California. Use this tool to discern what is and what is not negotiable on your telecom bill.

| Line Item on Telecom Bill | Type | Negotiable? |

| Federal Subscriber Line Fee (a.k.a., End User Common Line (EUCL) Charge) |

Carrier Fee | Sometimes |

| Access Recovery | Carrier Fee | Yes |

| Administrative Service Charge | Carrier Fee | Yes |

| Administrative Service Fee | Carrier Fee | Yes |

| Property Tax Surcharge | Carrier Fee | Yes |

| Property Tax Recovery Charge | Carrier Fee | Yes |

| Long Distance Access Charge | Carrier Fee | Yes |

| Network Access Assessment | Carrier Fee | Yes |

| Internet Access Fee | Carrier Fee | Yes |

| Carrier Cost Recovery Fee | Carrier Fee | Yes |

| Federal FCC Recovery Charge | Government Tax/Surcharge/Fee | No |

| Federal Universal Service Fund Fee | Government Tax/Surcharge/Fee | No |

| Federal Excise Tax | Government Tax/Surcharge/Fee | No |

| 911 Tax (a.k.a., Emergency Telephone Users Fund, State E911, County E911) |

Government Tax/Surcharge/Fee | No |

| State PUC Fee (a.k.a., PUC Tax (Fees), CA PUC Reimbursement Fee) |

Government Tax/Surcharge/Fee | No |

| State Telecom Relay Service (a.k.a., State TRS, Relay Service Communications Device Fund (DEAF) Surcharge, CA Relay Services & Comm Devices Fund) |

Government Tax/Surcharge/Fee | No |

| State Universal Service Fund Fee (a.k.a., CA Universal Lifeline Surcharge, State Universal Lifeline Telephone Charge) |

Government Tax/Surcharge/Fee | No |

| California Advanced Service Fund (a.k.a., California CASF) |

Government Tax/Surcharge/Fee | No |

| California High Cost Fund B Surcharge (a.k.a., State High Cost Fund Surcharge) |

Government Tax/Surcharge/Fee | No |

| California Teleconnect Fund Surcharge (a.k.a., State California Teleconnect Fund) |

Government Tax/Surcharge/Fee | No |

| City License Tax | Government Tax/Surcharge/Fee | No |

| Local Utility Users Tax | Government Tax/Surcharge/Fee | No |

Your telecom bill doesn’t have to be a roadblock along your journey to success. Though cleverly disguised fees are hazardous to your bottom line, you now know what to look for to avoid them. So, put the brakes on telecom fees and put your hard-earned cash where it belongs: in your bank account.

If you want to reduce more costs, work with the full-service marketing agency of Simple Business Solutions. We'll employ our data-driven marketing strategy and brand development services to take your business to the next level!